Compliance Guard empowers compliance teams with unparalleled visibility into retail trader behaviors, arming professionals with actionable insights to get ahead of risks and demonstrate regulatory adherence. Compliance Guard enables timely interventions and proactive risk mitigation by tracking activities, surfacing negative patterns, and providing real-time alerts.

Robust API integrations and reporting enhance KYC processes and transparency. Financial institutions can evolve compliance strategies from reactive to predictive with Compliance Guard’s behavioral analytics capabilities, intervening on potential threats early and maintaining stakeholder trust.

KYC Applications

Enhance your Know Your Customer processes with deep behavioral insights

Comprehensive Reporting

Generate detailed reports on trader behaviors, ensuring transparency

KYC Applications

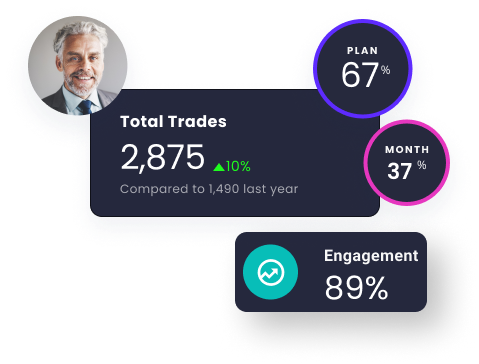

Compliance Guard supercharges KYC processes with robust profiles of each retail trader built from behavioral data analysis. Granular insights into account activities, patterns, and risk levels enable truly knowing your customer versus relying on forms alone.

Comprehensive Reporting

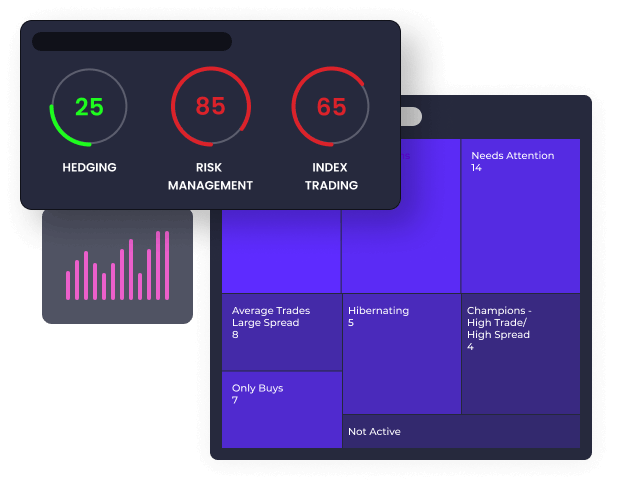

Digestible reports on trader behaviors and risk levels with just a few clicks, ensuring transparency for audits and reporting. This proactive 360° view enables compliance teams to get ahead of risks and demonstrate adherence through the data-driven intervention of negative behaviors.

Ready to Transform Your Compliance Strategy?

With Compliance Guard, you can evolve from reactive to predictive compliance through proactive behavioral insights. Gain an advantage by identifying risks early and demonstrating adherence.

Get in touch today to see how PersonaFin can enable personalized financial experiences on your platform.